By Supreet Manchanda

•

September 20, 2022

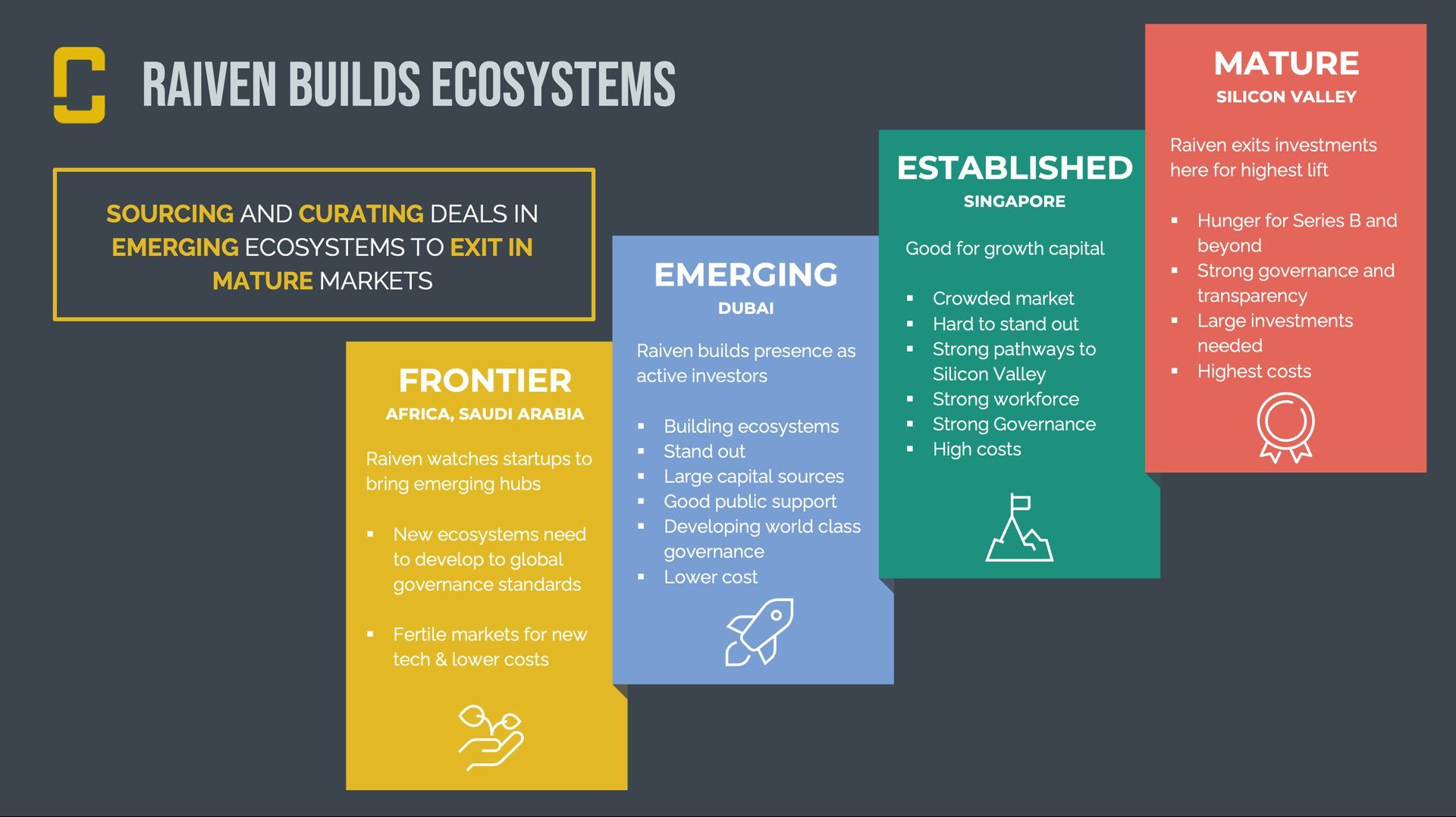

Preamble Raiven Capital is a global early-stage technology venture capital fund that believes in the power of innovation. The fund seeks to strengthen the ecosystems that it invests in, building bridges and contributing to thought leadership in venture capital. The goal is to foster innovation and provide insight to founders across the world, contributing to their operational playbooks. This whitepaper summarizes findings from Raiven’s inaugural research project. In a world where the future of work is already here, we wanted to provide deeper insights into the changing work world. In addition, how do we understand and operationalize insights from across the literature? Raiven’s larger goal is to take a deeper look at how to support tech companies and navigate the landscape of remote work in a more nuanced way. Abstract The current state of business and organizational literature looks at the future of work and addresses best practices in hybrid and remote work, the changing workplace culture and the leadership required to lead in this complexity. Five startups participated in a two-hour scenario and transcripts of the sessions were analyzed according to established qualitative methodologies. The timed scenario involved a challenging situation a tech company would normally face. Partway through the scenario a change that increased the stress/urgency of the situation was introduced. Once the scenario was completed, the teams were each invited to debrief. A new theme that emerged from the research: an organization that creates a culture map for the whole team that lives within it and is based on a high emotional intelligence, is able to navigate the stressors of a remote work environment with more clarity, innovation and ease. In addition, the clearer the map for external relationships, the clearer the strategy is to address challenges that arise due to client needs. Companies that had a clear internal and external relationship map had better success. The tools bridged the gap of remote work to create better cohesion and symmetry within teams. Culture maps (internal) and relationship maps (external) became the “glue” that helped remote teams generate trust, communicate effectively, and work more efficiently and innovatively within teams. Background The future of work is a topic often addressed in business and tech literature. Discussion includes many trends and “how to” guides. Much of it focuses on a post-pandemic phenomenon: “The Great Resignation” which includes the 40% of tech workers that have left or planned to quit (Deczynski, 2021). The pandemic reinforced individuals’ beliefs – that their life had value and mattered. Work was not just a place to be. Now, employees want money, benefits, flexibility not just in days, but in how they spend their hours. They want a workplace that fosters creativity and collaboration, and offers a healthy workplace culture (Deczynski, 2021, Downs, 2021). People quit six-figure jobs to prioritize mental health and travel. They also began searching for fulfilling, flexible careers. The cult of being busy is no longer acceptable. People want life-work integration (Groff, 2021, Fox, 2021). Even the four-day work week is passé. The broader question: What does the organization need to actually “work?” How does it collaborate, meet individual differences and needs, foster productivity and happiness (Collin, 2021, Weikle, 2021)? How do leaders and organizations respond to navigate the complexity? The current literature falls into three main categories: hybridized or remote work, workplace culture, and leadership. Hybridized or Remote Work The literature reinforces that remote, or asynchronous environments can work, but what is critical is creating a culture that values it. Remote work will remain and account for 48% of the workforce by 2030 (Bleimschien, 2021). Communication is key. Team members must learn to navigate and communicate effectively across time zones and cultures. Collaboration styles may differ. Private communication is not helpful most of the time.Transparent work where others can see one’s work and pick up where others left off make most meetings unnecessary. If there are meetings, who attends? Are there minutes for review? Agreed upon deliverables provide measurable results (Tucker, 2021). Meetings should be in response to specific milestones; this fosters productivity (Carr, 2021). Each participant should have clear engagement and understand how to engage in advance of the meeting so that meetings are productive, and have full participation and buy-in (Steen, 2021). Note: a seamless flow of information between teams and immediate access to information and use of all technology is required for full participation (Bleimschein, 2021). Does remote work “work”? According to the research, it is built for cooperation not collaboration (Ramesh, 2021). Others argue that short-term productivity goes up, but long-term creativity goes down because there is a damper on collaboration and innovation. Real-time conversations and corridor chat are not often replicated in the virtual world (Stillman, 2021). Mentorship and developing new friendships become more difficult (Glasser, Cutler, 2021). Unplanned “collision conversations” are needed. These types of conversations are exciting, full of brainstorming and innovations (Glasser, Cutler, 2021). The literature states: “Workers want to work with people they like and in systems that engage them for the money they think they’re worth. A virtual experience that fails to deliver professional fellowship and intriguing challenge, will cause a worker to feel unconnected from their work.” Intentional collaboration is key (Carr, 2021). People need to make sense of things with one another. Humanizing experiences engender belonging and trust (Hobson,2021). Employee experience is just as important and can include virtual water cooler and townhall discussions, as well as socializing instead of agenda-based meetings (Hobson, 2021). Building a hybridized and remote work environment is not a one-size-fits-all. It is important to understand what models enable the best workflows, despite the history of the organization. Workplace Culture Workplace culture consists of tacit agreements about values, ethics and operations that shape the attitudes and behaviors within an organization. They define what is encouraged, discouraged, accepted nor rejected within a group (Groysberg, Lee, Price & Cheng, 2018). In post-pandemic digital workplaces, the culture is being redefined. Some workplaces always strived for ethics, integrity, wellness, creativity, diversity & inclusion. These values are now in high demand from employees and have become a factor in company resignations. Employees and investors value integrity. Honest brands are valued (Schwates, 2021). Employees want to belong and be recognized for accomplishments, while being able to accommodate family obligations (Ramesh, 2021). Mike Prokopeak, editor in chief of Reworked, noted that in the digital workplace, the human element of work is the most important. “The team we build, the people we develop and support, and the mission we choose to pursue together…It’s the values we share, the dreams we pursue together, and the quality of our relationships that will define whether or not we succeed.” (Rodgers & Nicastro, 2021, Williams, 2021). In other words, technology will only get us so far. The capacity to collaborate is the biggest predictor of a remote team’s success. Emotional intelligence is needed: who is best at what? What else is important: clearly defined leadership, communication, coordination, transparency, time management and responsiveness. Emotional intelligence is needed for effective meetings (Moore, 2021) and to navigate what is needed for remote work. Social skill and social perceptiveness are relevant too (Riedl, Malone & Woolley 2021, Moore, 2021). Leadership In the future of work literature, leadership needs to understand that remote and hybridized work is here to stay and requires a reframing: work is not just hours given. An employee’s engagement needs to be meaningful, not rote. It is important to shift to valuing productivity over longer days (Ramesh, 2021). Leaders need to challenge the assumptions that underlie facetime (Stockpole, 2021), and they need to respect time outside work. There must be mutual trust that work will get done, especially with flexible hours. An idea: evaluate work based on productivity, not time (Stewart, 2021, Rodgers & Nicastro, 2021). Leaders need to understand that creativity comes from incubating and shifting focus, so downtime is equally important to increasing productivity (Nova, 2021). This shift in thinking allows for upward mobility despite remote locations. Leaders need to think human centric and must have the skills to manage human differences (Carr, 2021). Creating a healthy and productive workplace culture is related to emotional intelligence. Creating a team of lifelong learners who possess self-leadership and interpersonal engagement is also key (Rodgers & Nicastro, 2021). Further, hybrid or remote work must be accessible to all, whether it be equipment for a home office, training on technology, or accessible child care, especially for women. Women end up being responsible for the majority of unpaid work for child care, home care or elder care when working from home (Youn, 2021, Hobson, 2021, Rooney, 2021). The Gap and the Research As was noted before, the literature states that the future of work is here, stressing that key high-level assumptions are shifting. Actions and attitudes need to follow in response. Technology is already at the cutting-edge of many of these trends. Qualitative analysis allows for a small sample size to show repeated themes. These reveal new insight that can only be found in listening to experience and deeper verbal content versus a question and answer-type analysis. The simulation began with a situation each team would address in their day-to-day operations, somewhat stressful, with some time pressure. Then, at the 30 minute mark, they were thrown a curveball. The new information in the scenario significantly increased the pressure. Each team had 1.5 hours to approach and resolve the situation together. Then, each team had the opportunity to debrief and reflect on their experience and their individual performance. Each section (the initial scenario, the curveball, and the debrief) revealed aspects about the team, their communication, their collaboration, and their ability to navigate remote work. What became clear: the less noise and more creativity possible through a seamless ability to navigate remote work, the more capacity the organization has to pursue its goals. The Results The results reinforced, but also went beyond the literature. The companies that solved the scenario well – understanding instructions, collectively and efficiently coming up with an approach and response to the initial scenario, approaching the crisis in a clear, calm way with an integrated solution – reinforced the current literature about remote work. The others failed to come to a solution. However, two crucial themes also emerged. The companies that were able to solve the scenario easily and successfully had a very clear internal culture map , which is the foundation for a very clear external relationship map . “Culture is the tacit social order of an organization: It shapes attitudes and behaviors in wide-ranging and durable ways. Cultural norms define what is encouraged, discouraged, accepted, or rejected within agroup. When properly aligned with personal values, drives, and needs, culture can unleash tremendous amounts of energy toward a shared purpose and foster an organization’s capacity to thrive” (Groysberg, Lee, Price & Cheng, 2018). When culture is embedded throughout the layers of the organization with behaviors, values, processes and operational actions and strategy, a “map” is created for the organization. It is a silent language that guides the journey, leading to ways that stakeholders, customers and clients relate, helping define the experience from beginning to end. The responses to company scenarios reflect that the culture map (inward facing) and the relationship map(external facing) become a glue that helps mitigate and manage conflict in remote work, communication and relationships. Specifically, as reflected in the literature, those companies that expressed emotional intelligence (self-perception, interpersonal skills, problem-solving and stress management skills) allowed a foundation for managing day-to-day relationships and approached crisis in a consistent and more efficient way that helped the teams feel connected and productive while giving a general sense of well-being. Beyond the mission and vision of a company, companies that handled the scenario most successfully had integrated and owned their vision. They built the culture map by sharing the vision collectively and individually. It did not exist just with a single or few people. There was a common sense of shared values that existed from a culture that engaged its people in an ongoing co-creation. While the vision may have stemmed from one person’s idea, the culture was now jointly held, at least to the degree of each person’s role. When the role of each team member was very clear. Each person knew each other’s strengths and weaknesses and how they fit together. There was clear camaraderie that allowed them to understand each other in nuanced ways. There was a shared understanding of differences in styles, culture, and personalities and they were able to manage time zones and were conversant with the shared technology. The companies that had cultures that reflected emotional intelligence (self-perception, interpersonal skills, problem solving and stress management skills) also were able to discuss vulnerability (within themselves and within their organization), gaps, ethics, relationships, and manage stress in a way that allowed these perceived challenges to become clear opportunities to address the gaps and problem solve to create better solutions or a better process. Culture maps defined roles and processes. These were often understood processes for crisis in communication, and clear channels, including platforms of technology, for communication. Rather than seeing them as negative, stressful situations were seen by these companies as another avenue to implement a strategic roadmap underpinned by an embedded culture. Creativity, communication and problem solving felt “natural”. The culture created bonding, a sense of shared values and trust, which was crucial, especially in a remote work environment. Leadership and engagement existed at all levels. The CEO took a secondary seat, inviting contribution and collaboration, waiting for synergy to create itself. Each member was equipped with the knowledge of all remote platforms/interactive technology used or needed. Each participant had a sense of logistics and priorities that the team needed to address the scenario. The culture and values being held by each team member allowed all voices to be heard or to speak up, all voices to challenge and question and all voices and contributions valued. Each person’s personality, area of expertise, and how their part fit into the whole was acknowledged. This clarity of what the cultural identity of the company is and is not, allowed most successful companies a greater sense of confidence. Teams took time to understand the scenario, grasp its implications for the team rather than plunging forward. They were able to assess the challenge in the context of who they were and apply it to their vision and culture to ensure that their approach matched who they were. This internal culture map led to a clear external relationship map. The companies that had the most success with the scenario were able to look at the customer/client and see who they were and create a clearer bridge to addressing the client’s needs and expectations in a way that was consistent with their culture. They were also able to assess if the client/customer was a fit and were ok with losing a client if it meant it was not a fit for the culture. They had a clear understanding of the experience they wanted their customer to have at each step with them and wanted to understand the impact of their approach on that experience. That external relationship map made it easier and more efficient to find solutions. In fact, it provided a foundation that allowed for more creativity in solving the crisis. At each choice point, these two maps: the “internal culture map” and the “external relationship map” became the foundation for decisions that allowed flow, ease and confidence. It created space for creativity,communication and a deeper capacity to analyze and solve the situation at hand. The fuzzier the internal culture map the fuzzier tackling the rest of the scenario became. What that means is that a number of organizational behaviors were affected on a varying basis. These included: an understanding of instructions, the roles individuals played, how they tackled the problems, how the team approached solutions, how the team discussed values, ethics, and managed themselves and each other. In companies where the leader still primarily held the culture, the conversation revolved around pleasing or supporting the leader’s vision. Dissent, challenge, looking at gaps or co-creation were less visible. Valuing and group dynamics were more unidirectional rather than collaborative and were not directed equally as members of the team. Communication didn’t have a flow. It was more haphazard. It took longer. Ironically, it required the leader to take more time and space to have to manage rather than having it held with the group. Gaps were often overlooked or there was inclination toward false bravado, relying on what worked, rather than a serious look at what wasn’t working. Without a clear culture map, it was also more difficult to test the gaps against where the company’s stated vision and culture and values indicated they wanted to be. There wasn’t as much confidence that allowed each person to contribute. They weren’t as able to see the client/customer needs and bridge to them. The less emotional intelligence and maturity within the team, the less insight they had about the process itself and its impact on creating solutions. The scenario highlighted that the clearer a company’s internal culture map and the clearer their external relationship map, the clearer the roles of each member were. Synergy existed and leadership was held within the whole team. Processes existed and unfolded more efficiently. The clearer the external relationship map, the better the understanding of the customer/client and the more they were able to execute their strategy to meet the experience they wanted the customer/client to have. Companies that valued emotional intelligence expressed more confidence and better communication. There was a sense of belonging, valuing and trust within the team. The internal culture map and external relationship map bridged the gap of remote work to create better cohesion and symmetry within teams. These initial qualitative findings indicate the relationship between clear culture maps and internal and external relationships. Maps impact the ability to deliver strategy. They also create ease in remote work environments, especially in the tech industry. Further research would be required both qualitatively and quantitatively to further validate these findings. In conclusion, the implication for venture capital funds’ portfolio companies: startups that have clear internal and external culture maps embedded by top leadership can handle stress, crisis and the uncertainty. They are more efficient, productive, innovative and creative. References Bleimschein, Benedict Inc. July 27, 2021. “Use This Pyramid Framework to Effectively Manage HybridTeams.” Carr, David F. Venture Beat. October 19, 2021 “Gartner Prescribes a Human-centric, Hybrid-Focus for the Future of Work.” Collin, Mathilde. November 9, 2021. POVL . “The 4-Day Workweek is Not the Future of Work. The Future is Flexibility.” Deczynski, Rebecca. September 27,2021. MSN. “The Great Resignation is Going to Be a Shock –Hitting Some Industries Harder Than Others” Downs, Sophie. Inc. “PwC Survey: Employers Struggling to Keep Up With Changing Employee Expectations.” Fox, Erica Ariel. Forbes. October 18, 2021. “Work-Life Balance is Over – The Life-Work Revolution is Here” Glasser, Edward and Cutler, David. The Economist. September 24, 2021. “You May Get More Work Done at Home. But You’d Better Have Ideas at The Office.” Groff, Bree. Fast Company. October 3, 2021. “Leaders Are Thinking About Hybrid Work in a One Dimensional Way. There is a Better Approach. Groysberg, Boris, Lee, Jeremiah, Price, Jesse, and Cheng, J.yo-Jud. Harvard Business Review, January, 2018 “Corporate Culture.” Hobson, Nick. Inc. November 5, 2021. “The Obvious Psychological Truth Left out of Most Future of Work Conversations.” Nick Hobson. Inc. November 17, 2021. “Microsoft Research Reveals the Biggest Downside to Remote Work and Here’s How to Address it.” Moore, Dene. Globe and Mail. December 28, 2021. “Emotional Intelligence Trumps IQ in the Workplace and Women Have More of It.” Nova, Annie. CNBC. December 26, 2021. “How We Work From Home Needs to Change in the New Year.” Ramesh, A.R. Entrepreneur Magazine. July 6, 2021 “Reimagining the New Mandate For the Future Workforce” Riedl, Christoph, Malone, Thomas W. and Woolley, Anita W. Oct 21, 2021. MIT Sloan. “The Collective Intelligence of Remote Teams.” Rodgers, Gabrielle and Nicastro, Dom. Oct 20 2021. CMSWire. “5 Takeaways from the Fall 2021 Digital Workplace Experience Conference.” Rooney, Katharine. The Future. October 13, 2021 “These 5 Themes are Shaping the Future of Work.” Schwantes, Marcel. Inc. June 29, 2021 “Warren Buffet Thinks You Should Hire For Integrity First.” Stewart, Ben. Fast Company, July 29, 2021. “This Should be the Remote Workers’ “Bill of Rights.” Steen, Jeff. Inc. February 16, 2022. “High Profile Study Reveals Why Most Meetings are Ineffective. It Only TakesOne Simple Step to Fix It.” Stillman, Jessica. Inc. September 20, 2021. “New Microsoft Study of 60,000 Employees: Remote Work Threatens Long-Term Innovation” Stockpole, Beth. MIT Management. July 27, 2021 “Digital Transformation After the Pandemic.” Tucker, Matt. Entrepreneur. July 24, 2021. “How to Create an Asynchronous Work Culture.” Weikle, Brandie. CBC Radio. Dec 20, 2021. “Forget 9-5. These Experts Say the Time Has Come for the Results-Only Work Environment.” Williams, Shannon. Dec 27, 2021. IT Brief New Zealand. “The Future of Work is About People, Not Tech.”